Comprehensive Data Collection and Analysis Platform

Published: 2016-03-02

Background

The Guangxi Local Taxation Bureau involves numerous tax-related systems with different business positioning and technical frameworks, resulting in systems that operate independently with inconsistent data sources and statistical calibers. This makes it impossible to conduct cross-comparison of data between systems for tax analysis. The various cities lack data localization and uniformly connect to the regional bureau's production systems, causing excessive pressure on production systems. The scattered and independent systems lead to relatively single data analysis results, lacking comprehensive statistical analysis. Building a comprehensive data collection and analysis platform has become an urgent task.

Objectives

The goal is to integrate and localize data from the main tax-related systems, building a platform oriented toward data warehousing with flexible visualization queries and analysis capabilities, and rich report presentation. This provides municipal business departments and grassroots tax officials with a visualization customizable, high-performance, efficient, simple to use, and user-friendly comprehensive data collection and analysis platform.

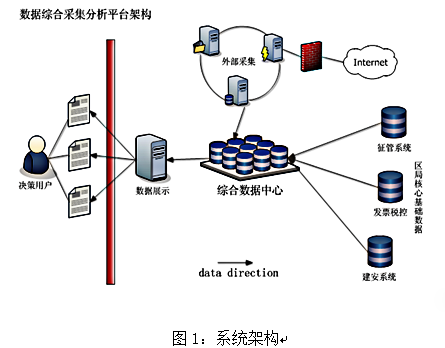

Overall Solution

Comprehensive Data Center

The comprehensive data center is built in the city, copying data from the regional bureau's tax administration, invoicing, and other systems to the data center through real-time replication tools and scheduled extraction commands, forming the core data of the comprehensive data center. Related external data for real estate, hotel industry, and other sectors are obtained through web crawlers and government cooperation as auxiliary data, forming a comprehensive localized data center.

External Collection

External data for key tax industries (such as real estate and tourism) are acquired through web crawlers and government cooperation. After standardization processing, this data is imported into the comprehensive data center, providing comprehensive baseline data for data analysis.

Application Effects

Data Center

Data is replicated from the regional bureau to the city, achieving localization and centralization of tax data. The data center enhances data security, with the city serving as a backup of the regional bureau's data, reducing the risk of data loss and implementing remote disaster recovery.

Report Display

Based on the city's own statistical calibers, risk indicators, and data standards, display reports and risk notifications are generated. These provide powerful reference for leadership decision-making, tax revenue analysis, and data quality improvement.

Risk Assessment Management

According to the risk indicator system, abnormal taxpayers are filtered out, risk reports are generated and pushed to appropriate personnel for processing, and processing results are fed back to the analysis platform. This implements a risk handling mechanism of "identifying problems" -> "pushing problems" -> "solving problems" -> "feedback results", effectively resolving potential tax-related risks and achieving tax revenue targets.

Client Feedback

1. Centralized data management not only improved the situation of asymmetric and non-unified information but also enhanced work efficiency and solved the problem of cross-system data query and comparison.

2. The data center, serving as a backup of the regional bureau's data, met the requirements for remote disaster recovery and enhanced data security and protection awareness.

3. Automated risk monitoring and notification helped enhance risk prevention awareness and optimized work methods and approaches.

4. Based on the characteristics of Guangxi's tax industry, an original risk management model was created, placing it at the forefront of the region's tax system.